Ignorance of the law is the core reason behind the failures of many estate planning processes. Every state has their own set of rules and regulations to perform specific tasks. It might differ when it comes to the right of people, property, and taxes.

For efficient planning, whether you want to draft a living trust, will, or power of attorney, you’ll need to understand the complex state rules.

However, if you’re unable to do it yourself, you should better take the assistance of the topmost Living trust attorney in Alexandria.

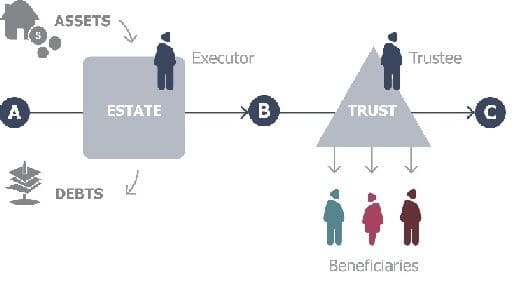

Let’s take a quick look of how a Living Trust works:

What does a Trust Attorney Do?

An attorney has a proficient and up-to-date knowledge of the state laws. So, he is capable of providing you with a comprehensive counseling on all the legal matters related to estate planning, asset protection, and tax planning.

A specialized Alexandria trust attorney does all the tasks related to creating and managing Trusts – revocable trust or irrevocable trust. He helps you get your affairs in order to make sure that your wishes are fulfilled after your demise under legal supervision. He can also provide legal assistance to the trustee if needed.

A trust attorney will also:

- Develop a plan to save you from taxes.

- Prepare health care directives.

- Help you in appointing the right trustee, or you can also select an attorney for this position.

- Take extra measures to help your children in managing your money.

- Make sure that you children don’t misspend what they inherit.

Should you write your own living trust?

Most people prefer drafting their Living Trust without any assistance to cut the cost of attorneys. It could lead to making numerous mistakes in the trust and their families getting into post-death chaos as the trust laws are complex as they vary from state to state.

It is always better to draft your documents under the supervision of well-versed specialized attorneys to ensure that everything is legal, than to pay them later to review your efforts.

What happens when you do not consult a Trust Attorney?

- You might ignore estate tax issues which could result in higher liabilities than necessary.

- Your assets will be distributed in a different way than what you decided and it could also lead to legal proceedings.

- You will create a trust that might fail to achieve your goals.

If you, too, are concerned about your family’s future, contact an Alexandria trust attorney to implement living trusts, wills, charitable trusts, family partnerships and estate planning documents etc. It’s always better to get a legal advice on these matters than to regret later.